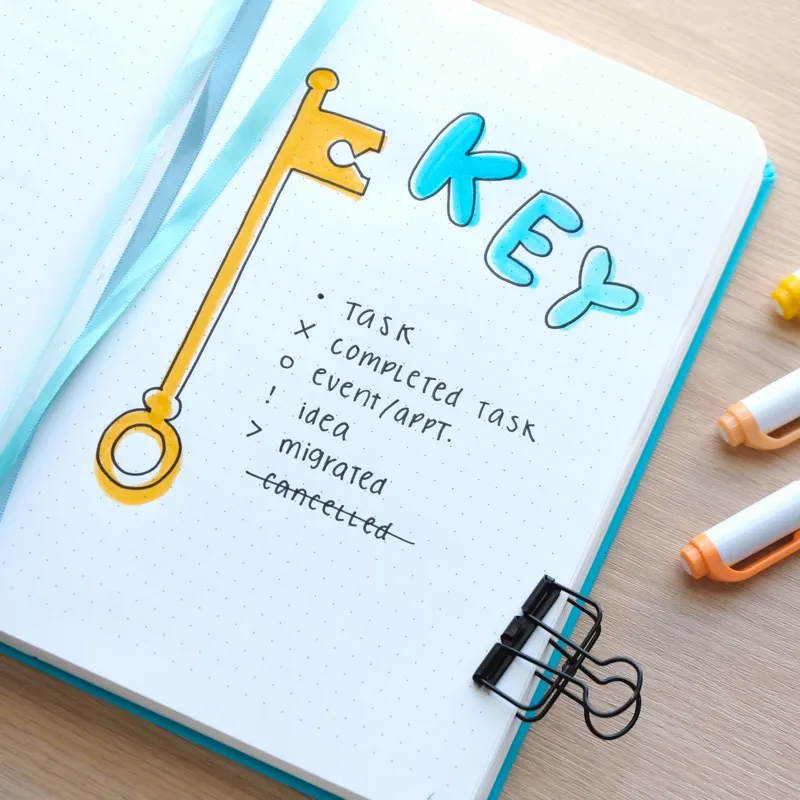

Bullet Journaling 101: How To Start A Bullet Journal

Learn everything you need to know about bullet journaling – how it works and how to be successful with it.

Bullet Journal Ideas

Learn everything you need to know about bullet journaling – how it works and how to be successful with it.

Bullet Journal Supplies

Everything you need to get started! Read bujo supplies reviews and see examples of notebooks, markers, and more in action.

Bullet journal washi tape

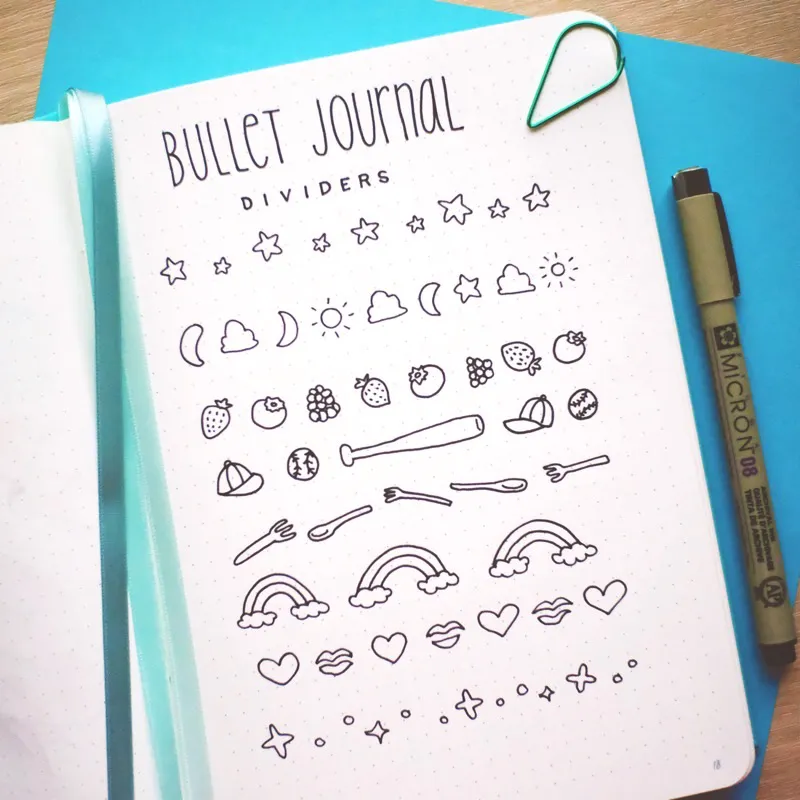

Bullet Journal Doodles

Learn how to draw some easy doodles in your notebook that’ll make them more fun and attractive.

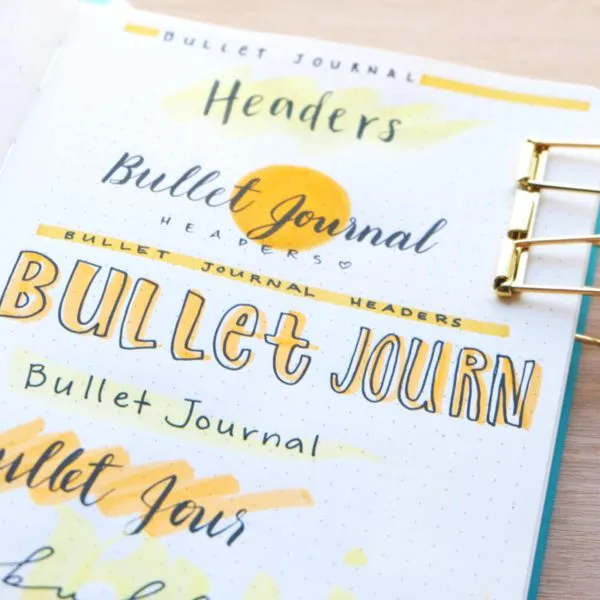

Bullet journal banners

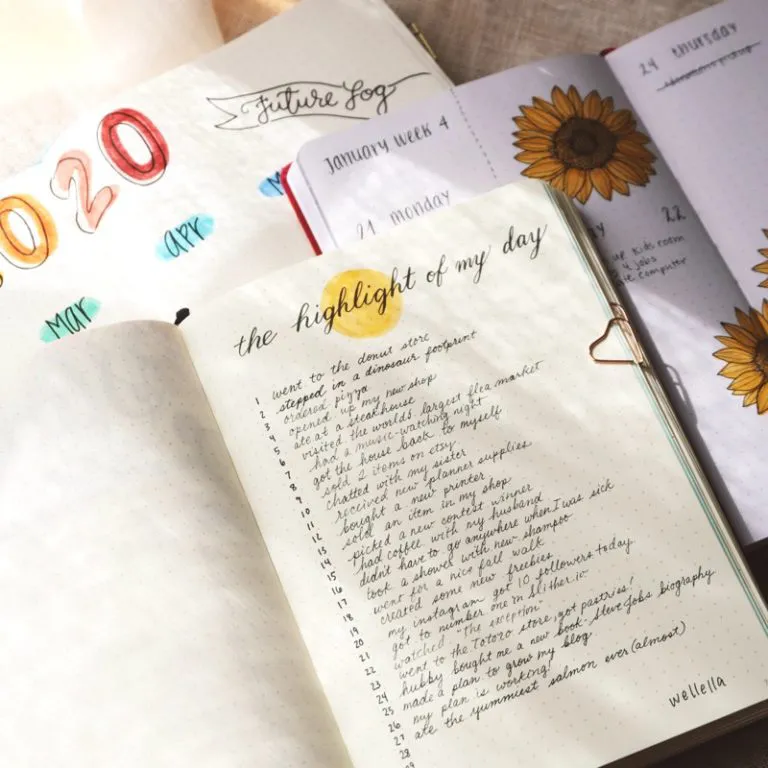

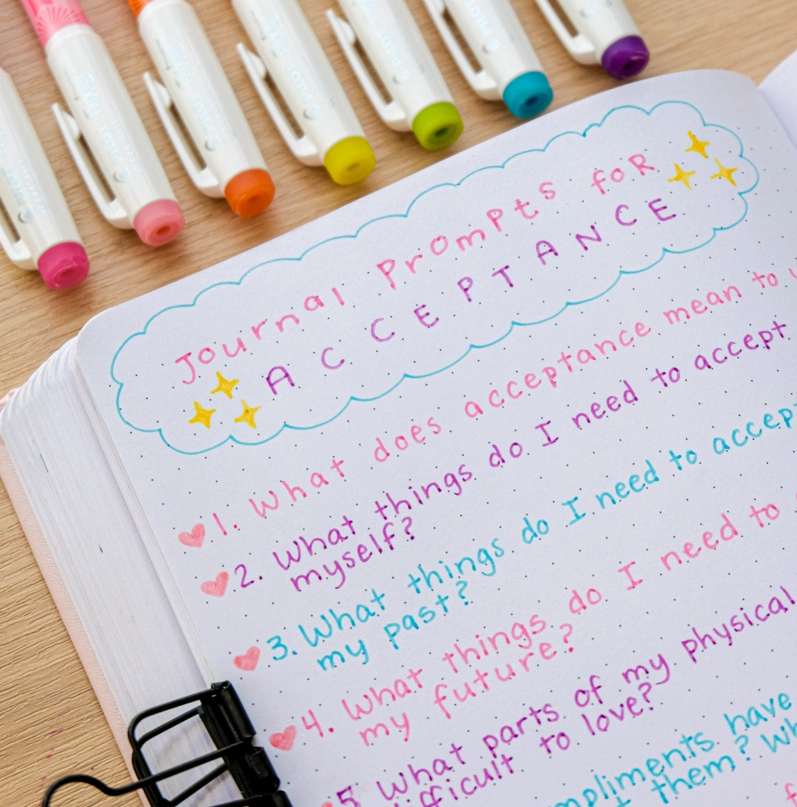

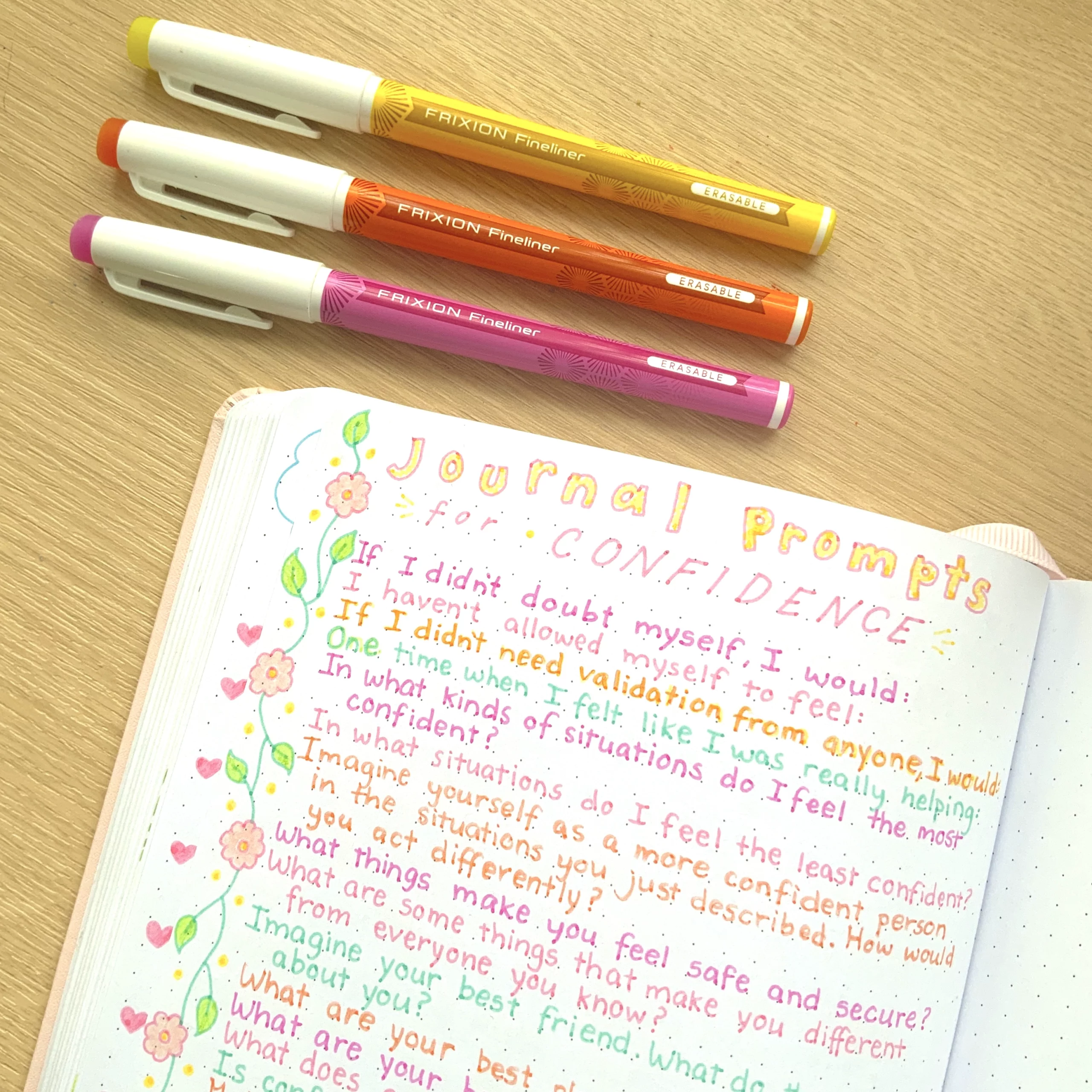

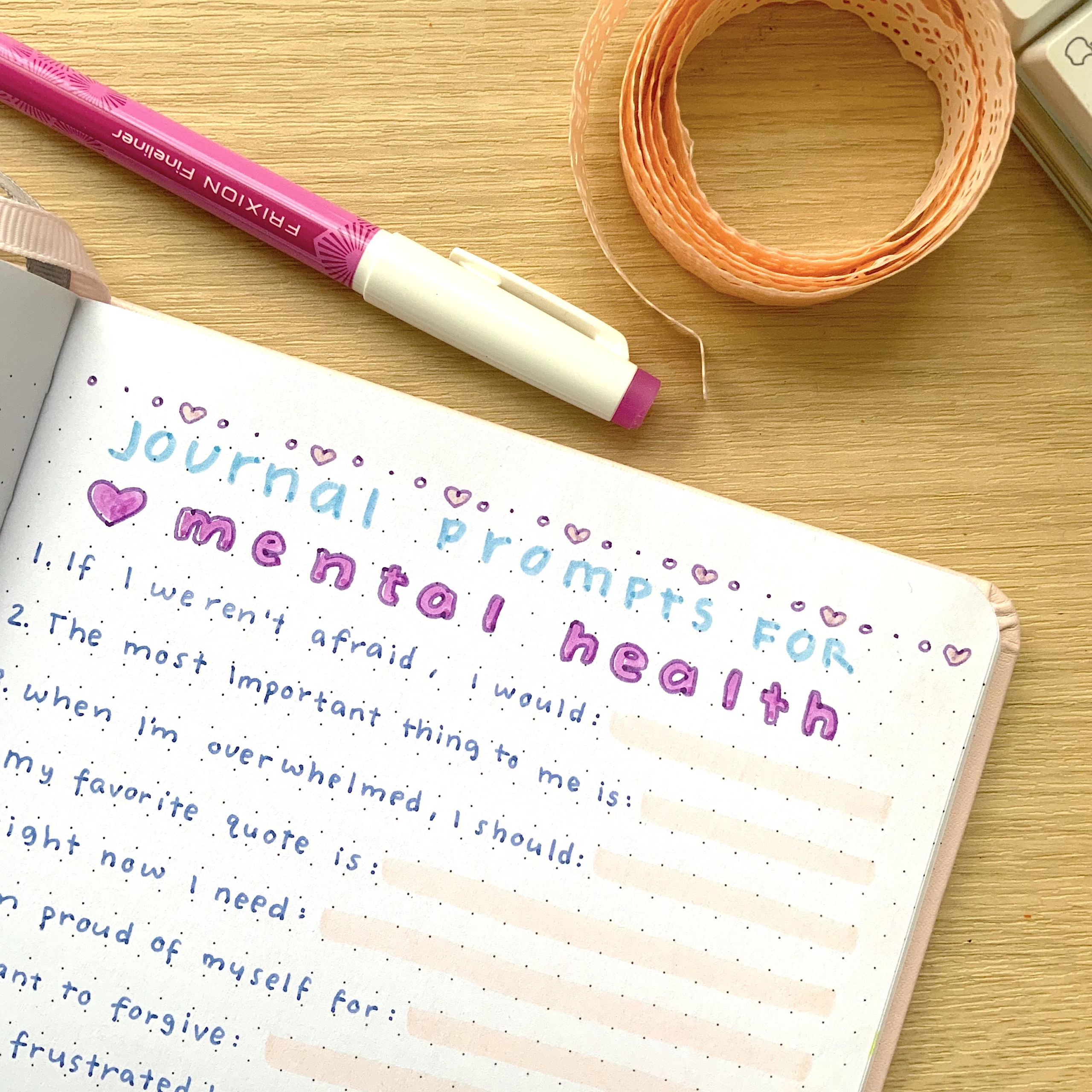

Journal Prompts

Get ideas on what to write about in your bullet journal with these collections of journal prompts.